Economic Impact Payment

This information was released by the IRS and last updated October 27, 2020. For additional information, please click here

You May Be Eligible to Receive Coronavirus Checks, Direct

Deposits

You must have a Social Security Number to be eligible. This includes green card holders, and it generally includes those on work visas, such as an H-1B and H-2A.

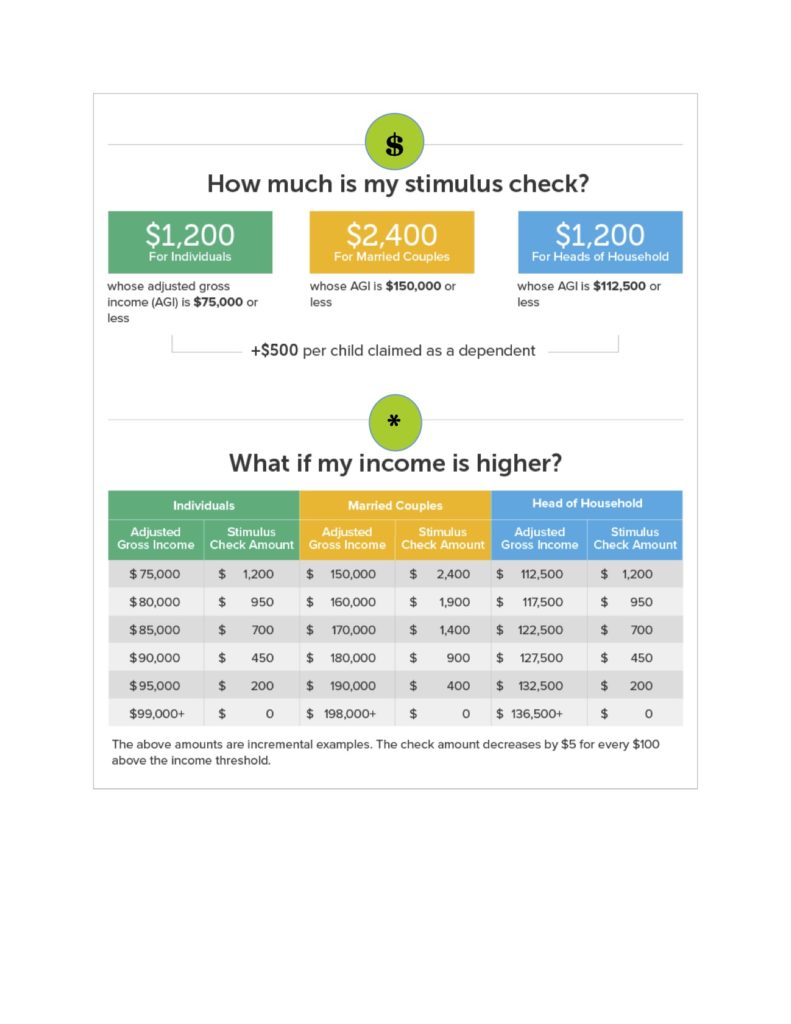

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds zeroing out at $99,000 for single filers.

For married couples, the phase-out range is $150,000 to $198,000.

People who are currently receiving Social Security retirement and disability payments are eligible.

People receiving unemployment payments are eligible.

Veterans are eligible.

Direct payments of $1,200 to most individuals making an adjusted gross income of up to $75,000, or $2,400 for couples making up to $150,000. Each dependent child age 16 years or under increases the amount by an additional $500. An individual who filed as “head of household” and earned $112,500 or less gets $1,200.

Even as an adult, you are not eligible to receive payment if you are claimed as a dependent. If your parents claim you as a dependent on their taxes, you’re ineligible. But if you’ve been working and filing taxes independently in recent years, you may qualify.

Individual and joint adjusted gross income will be used in calculating payment amounts. The numbers will be determined by one’s 2019 tax return filing. If someone has not prepared a 2019 tax return, it will be determined by the 2018 tax return. Even if you didn’t file a tax return for 2018 or 2019 or pay taxes in those years, you will be eligible if you received a Form SSA-1099 for the year 2019. That’s a form that the Social Security Administration sends each year to people who receive Social Security benefits, including retirement and disability.

The IRS may reduce the amount you receive if you have past due child support payments that have been reported by states to the Treasury Department.

Americans who were not required to file taxes in the last two years will have to file a “simple tax return” with basic information like filing status, number of dependents and bank information so the government can send the money. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.

There is no application process for payment.

The IRS will disburse payments via direct deposit based on bank account information that you have provided to them.

Those without a bank account on file should receive checks in the mail, which will take longer.

In the coming weeks, the government plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

Payments are scheduled to be disbursed within 3 weeks of bill signing, followed by a mail notice notifying individuals of their disbursement within 2 weeks.

Disbursements will not be subject to income taxes.

This will be a one-time payment.